Georgia Sales Tax Used Cars . It replaced sales tax and annual ad valorem. there is no sales tax on a used car in georgia, but there is a 6.6% tax called the title ad valorem tax (tavt) that will. This is a tax based. sales & use tax. You'll need your vin, vehicle sale date, and georgia residency date to use the ad valorem tax. There is also a local tax of between 2% and 3%. Georgia sales and use tax. use ad valorem tax calculator. when buying a car in georgia, you’ll pay 6.6% of the fair market value, whether you buy from a private seller or a car dealer. georgia collects a 4% state sales tax rate on the purchase of all vehicles. On this page, find information and forms related to sales and use taxes. georgia has no sales tax on new & used vehicles, but it does have a title ad valorem tax of 7%.

from www.carsalerental.com

sales & use tax. when buying a car in georgia, you’ll pay 6.6% of the fair market value, whether you buy from a private seller or a car dealer. georgia collects a 4% state sales tax rate on the purchase of all vehicles. There is also a local tax of between 2% and 3%. On this page, find information and forms related to sales and use taxes. use ad valorem tax calculator. there is no sales tax on a used car in georgia, but there is a 6.6% tax called the title ad valorem tax (tavt) that will. You'll need your vin, vehicle sale date, and georgia residency date to use the ad valorem tax. georgia has no sales tax on new & used vehicles, but it does have a title ad valorem tax of 7%. This is a tax based.

Sales Tax On A Car In Car Sale and Rentals

Georgia Sales Tax Used Cars when buying a car in georgia, you’ll pay 6.6% of the fair market value, whether you buy from a private seller or a car dealer. Georgia sales and use tax. This is a tax based. You'll need your vin, vehicle sale date, and georgia residency date to use the ad valorem tax. On this page, find information and forms related to sales and use taxes. georgia collects a 4% state sales tax rate on the purchase of all vehicles. There is also a local tax of between 2% and 3%. use ad valorem tax calculator. there is no sales tax on a used car in georgia, but there is a 6.6% tax called the title ad valorem tax (tavt) that will. It replaced sales tax and annual ad valorem. sales & use tax. when buying a car in georgia, you’ll pay 6.6% of the fair market value, whether you buy from a private seller or a car dealer. georgia has no sales tax on new & used vehicles, but it does have a title ad valorem tax of 7%.

From dylingulliver.blogspot.com

Hourly pay calculator ga DylinGulliver Georgia Sales Tax Used Cars This is a tax based. You'll need your vin, vehicle sale date, and georgia residency date to use the ad valorem tax. georgia collects a 4% state sales tax rate on the purchase of all vehicles. It replaced sales tax and annual ad valorem. use ad valorem tax calculator. There is also a local tax of between 2%. Georgia Sales Tax Used Cars.

From www.bondexchange.com

Auto Dealer Bond A Comprehensive Guide Georgia Sales Tax Used Cars there is no sales tax on a used car in georgia, but there is a 6.6% tax called the title ad valorem tax (tavt) that will. There is also a local tax of between 2% and 3%. sales & use tax. On this page, find information and forms related to sales and use taxes. Georgia sales and use. Georgia Sales Tax Used Cars.

From www.signnow.com

Sales Tax St 3 20182024 Form Fill Out and Sign Printable PDF Georgia Sales Tax Used Cars there is no sales tax on a used car in georgia, but there is a 6.6% tax called the title ad valorem tax (tavt) that will. You'll need your vin, vehicle sale date, and georgia residency date to use the ad valorem tax. This is a tax based. when buying a car in georgia, you’ll pay 6.6% of. Georgia Sales Tax Used Cars.

From www.exemptform.com

Department Of Revenue Sales Tax Exemption Form Georgia Sales Tax Used Cars georgia collects a 4% state sales tax rate on the purchase of all vehicles. Georgia sales and use tax. use ad valorem tax calculator. There is also a local tax of between 2% and 3%. when buying a car in georgia, you’ll pay 6.6% of the fair market value, whether you buy from a private seller or. Georgia Sales Tax Used Cars.

From gacovid19.org

Sales Tax August COVID19 Georgia Sales Tax Used Cars when buying a car in georgia, you’ll pay 6.6% of the fair market value, whether you buy from a private seller or a car dealer. It replaced sales tax and annual ad valorem. There is also a local tax of between 2% and 3%. use ad valorem tax calculator. there is no sales tax on a used. Georgia Sales Tax Used Cars.

From www.salestaxsolutions.us

Sales Tax in Sales And Use Tax Filing Georgia Sales Tax Used Cars georgia has no sales tax on new & used vehicles, but it does have a title ad valorem tax of 7%. Georgia sales and use tax. use ad valorem tax calculator. On this page, find information and forms related to sales and use taxes. georgia collects a 4% state sales tax rate on the purchase of all. Georgia Sales Tax Used Cars.

From www.youtube.com

Dealers Sales Tax License & Employment ID Number Requirements Georgia Sales Tax Used Cars use ad valorem tax calculator. There is also a local tax of between 2% and 3%. georgia has no sales tax on new & used vehicles, but it does have a title ad valorem tax of 7%. It replaced sales tax and annual ad valorem. Georgia sales and use tax. You'll need your vin, vehicle sale date, and. Georgia Sales Tax Used Cars.

From www.quaderno.io

How to Register & File Taxes Online in Georgia Sales Tax Used Cars On this page, find information and forms related to sales and use taxes. georgia has no sales tax on new & used vehicles, but it does have a title ad valorem tax of 7%. use ad valorem tax calculator. You'll need your vin, vehicle sale date, and georgia residency date to use the ad valorem tax. georgia. Georgia Sales Tax Used Cars.

From www.strashny.com

State and Local Sales Tax Rates, Midyear 2021 Laura Strashny Georgia Sales Tax Used Cars georgia has no sales tax on new & used vehicles, but it does have a title ad valorem tax of 7%. georgia collects a 4% state sales tax rate on the purchase of all vehicles. when buying a car in georgia, you’ll pay 6.6% of the fair market value, whether you buy from a private seller or. Georgia Sales Tax Used Cars.

From co.grand.co.us

Sales Tax License Grand County, CO Official Website Georgia Sales Tax Used Cars On this page, find information and forms related to sales and use taxes. when buying a car in georgia, you’ll pay 6.6% of the fair market value, whether you buy from a private seller or a car dealer. georgia has no sales tax on new & used vehicles, but it does have a title ad valorem tax of. Georgia Sales Tax Used Cars.

From startup101.com

How To Get A Sales Tax Certificate of Exemption StartUp 101 Georgia Sales Tax Used Cars It replaced sales tax and annual ad valorem. georgia collects a 4% state sales tax rate on the purchase of all vehicles. there is no sales tax on a used car in georgia, but there is a 6.6% tax called the title ad valorem tax (tavt) that will. On this page, find information and forms related to sales. Georgia Sales Tax Used Cars.

From msdtaxlaw.com

Sales Tax Archives Georgia Sales Tax Used Cars Georgia sales and use tax. georgia has no sales tax on new & used vehicles, but it does have a title ad valorem tax of 7%. It replaced sales tax and annual ad valorem. georgia collects a 4% state sales tax rate on the purchase of all vehicles. You'll need your vin, vehicle sale date, and georgia residency. Georgia Sales Tax Used Cars.

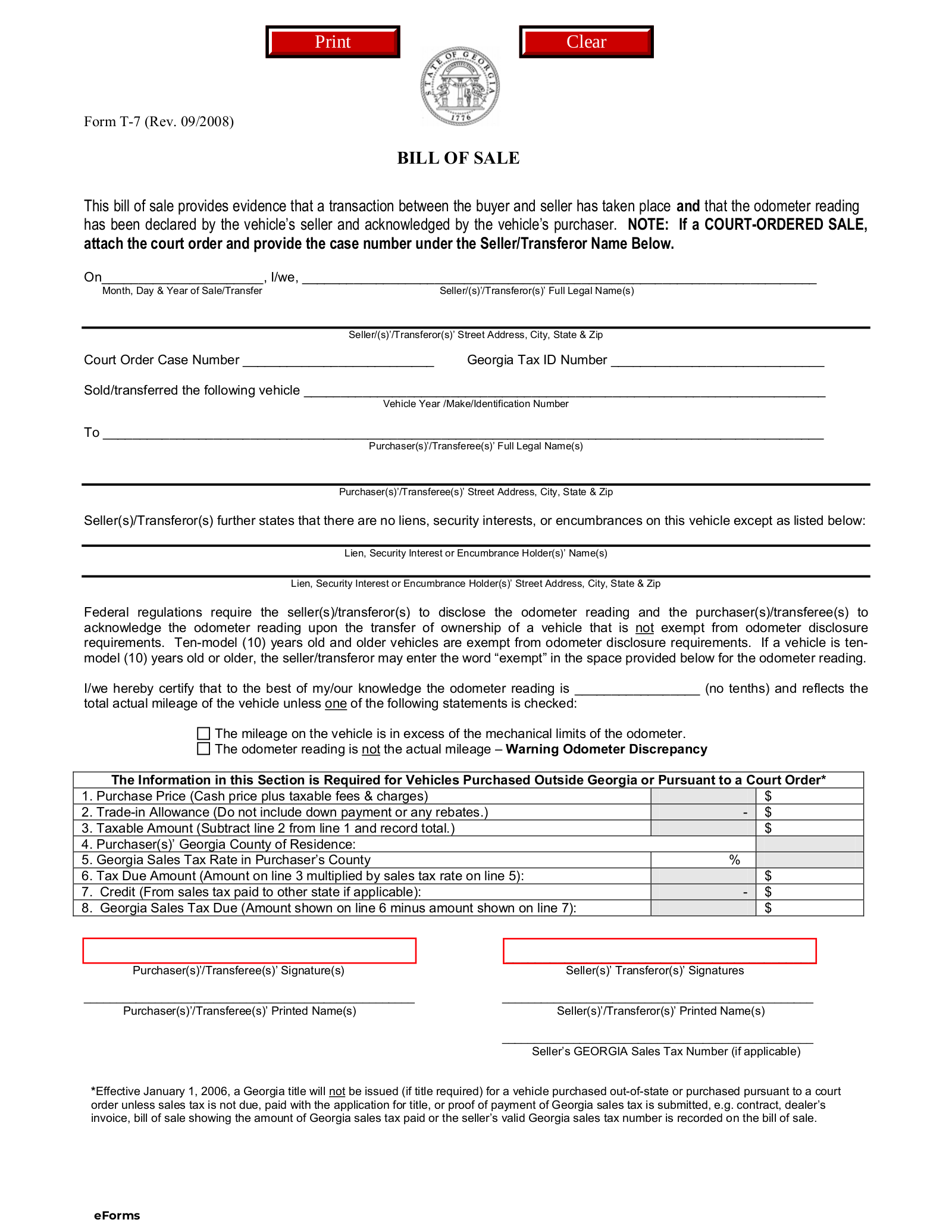

From www.formsbirds.com

Vehicle Bill of Sale Free Download Georgia Sales Tax Used Cars You'll need your vin, vehicle sale date, and georgia residency date to use the ad valorem tax. On this page, find information and forms related to sales and use taxes. use ad valorem tax calculator. This is a tax based. georgia collects a 4% state sales tax rate on the purchase of all vehicles. Georgia sales and use. Georgia Sales Tax Used Cars.

From dmvbillofsaleform.net

Bill of Sale Form DMV GA Information Georgia Sales Tax Used Cars when buying a car in georgia, you’ll pay 6.6% of the fair market value, whether you buy from a private seller or a car dealer. Georgia sales and use tax. This is a tax based. georgia collects a 4% state sales tax rate on the purchase of all vehicles. sales & use tax. You'll need your vin,. Georgia Sales Tax Used Cars.

From publiccarauctionscalifornia.com

Sales Tax on Used Cars in California Auto Auctions California Georgia Sales Tax Used Cars when buying a car in georgia, you’ll pay 6.6% of the fair market value, whether you buy from a private seller or a car dealer. use ad valorem tax calculator. On this page, find information and forms related to sales and use taxes. Georgia sales and use tax. This is a tax based. georgia collects a 4%. Georgia Sales Tax Used Cars.

From www.youtube.com

Tax Sales Redeemable Tax Deeds YouTube Georgia Sales Tax Used Cars use ad valorem tax calculator. when buying a car in georgia, you’ll pay 6.6% of the fair market value, whether you buy from a private seller or a car dealer. sales & use tax. You'll need your vin, vehicle sale date, and georgia residency date to use the ad valorem tax. It replaced sales tax and annual. Georgia Sales Tax Used Cars.

From gacovid19.org

Sales Tax May COVID19 Georgia Sales Tax Used Cars georgia has no sales tax on new & used vehicles, but it does have a title ad valorem tax of 7%. when buying a car in georgia, you’ll pay 6.6% of the fair market value, whether you buy from a private seller or a car dealer. use ad valorem tax calculator. There is also a local tax. Georgia Sales Tax Used Cars.

From www.formsbank.com

Form St4 Certificate Of Exemption Out Of State Dealer Georgia Sales Tax Used Cars It replaced sales tax and annual ad valorem. You'll need your vin, vehicle sale date, and georgia residency date to use the ad valorem tax. There is also a local tax of between 2% and 3%. use ad valorem tax calculator. georgia collects a 4% state sales tax rate on the purchase of all vehicles. when buying. Georgia Sales Tax Used Cars.